Engineering simulations – key for SMEs to unlock Industry 4.0

Traditional ways of work simply aren’t any more sustainable and effective, because the still ongoing technological revolution is reshaping all products and services that have been made before, giving place to new ones, even new concepts, and work titles.

What hasn’t changed is that small-to-medium-sized manufacturers (SMEs) still play an important role in the world economy, as they represent 90% of businesses and that includes the manufacturing industry in the US and other places. Of 250K manufacturers in the U.S., 240K are SMEs. The U.S. manufacturing sector was valued at about $2.1 trillion in 2018 and for every $1.00 spent in U.S. manufacturing another $1.80 is added to the economy.

Fundamentally speaking, Industry 4.0 includes many concepts mostly consisting of the fruits of the technology revolution, for example:

- Additive Manufacturing;

- Machine Learning;

- Simulation Systems;

- Digital Twins;

- Big Data & Predictive Analytics;

- IoT;

- Augmented Reality;

- The Cloud and more.

Why are SMEs slower on implementing Industry 4.0?

These technology upgrades open opportunities for large and small enterprises, but one is dependent on the other. Large manufacturers are actively moving towards digital transformation and Industry 4.0, but the SMEs are slower on taking and implementing the decision to transit to Industry 4.0. When large manufacturers push expensive and complicated simulation solution integration in supply chains, SMEs become a bottleneck in innovation as there are a lot of misconceptions surrounding changes. But once SMEs implement tech innovations in their business, they boost innovation and product quality, save energy, material, time costs, can even offer faster production time and a wider variety of products.

However, before SMEs go all-in to implement tech innovations or before large enterprises enforce change on their supply chain (SMEs as the common case), process analysis should be conducted for a step-by-step upgrade approach for a smooth transition. Otherwise the “upgrade process” may turn out to be painful or even impossible to perform.

Large aircraft supply chain case example

At the ASM Heat Treat show in Detroit (MI) in October 2019, Jack Harris (Chairman of IMS International) stated that adoption of advanced manufacturing technology is essential for SMEs to remain competitive and relevant to global supply chains. SMEs may lack the understanding regarding what technologies will benefit their processes and the necessary resources for implementation, or have the right skilled workers for operation.

In his keynote “Technology Risks for Small to Medium Sized Manufacturers”, he gave an example of a large aerospace manufacturer which tried to push down enterprise-grade technology CATIA adoption in SMEs supply chain which became harmful to the SME survival. In return, it harmed the SMEs and froze operations for some time since CATIA was an expensive investment for many smaller suppliers and they were not even able to use the software properly due to lack of trained staff.

So the moral of this story is – industrial revolution needs SME-tailored tools to succeed in the 4th Industrial revolution and the current state enterprise-grade software isn’t quite the best fit.

So how to find the right tools that yield the best benefits? And what are some of the misconceptions about the simulation systems as an important part of Industry 4.0 transformation in manufacturing?

Simulation software adoption is growing

The global simulation software market size is expected to reach $19.4 billion by 2025, rising at a market growth of 15.3% CAGR during the forecast period of 2019 – 2025. If simulation software wouldn’t give an impactful benefit to business growth, why would enterprises invest so much in it?

For instance, General Electric uses the digital environment to inform the configuration of each wind turbine prior to construction and generate 20% gains in efficiency by analyzing the data from each turbine that is fed to its virtual equivalent. In other cases, computer simulations are replacing expensive car aerodynamics tests in wind tunnels and impact tests, as well they can reveal how to maximize a car’s fuel efficiency and tire worn out. This shows that the benefits are undeniable however the change in the process is complicated and requires time.

What’s holding back from simulation adoption in SMEs?

There are a couple of valid reasons and misconceptions that can make engineers hesitate before trying or implementing simulation systems.

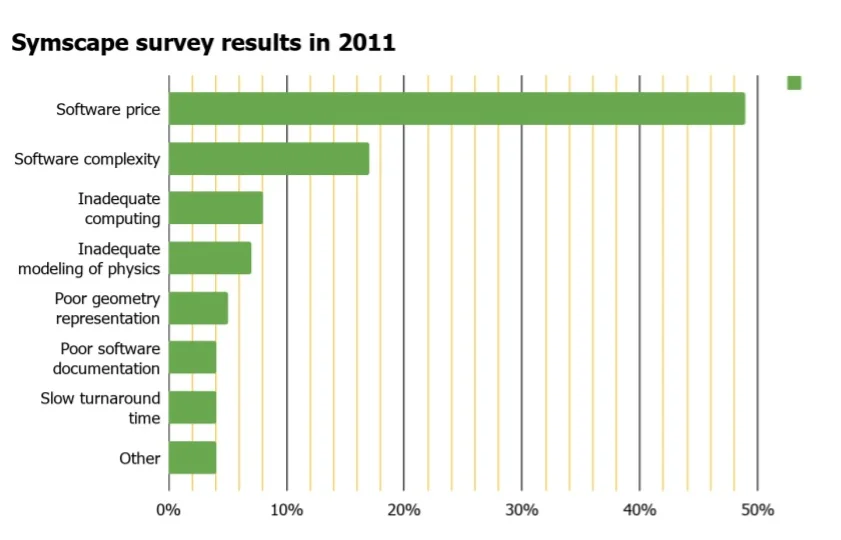

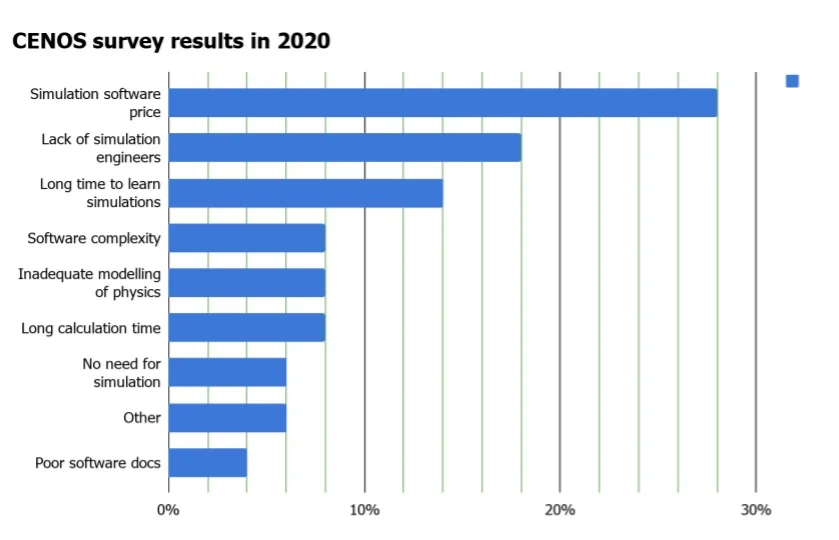

When Symscape made a survey in 2011 about “What is the biggest barrier to CFD (computational fluid dynamics) adoption?”, results were:

In Winter 2020, CENOS asked induction heating engineers about the biggest barriers to adopting simulation software in their company and the results were similar:

Breaking down the misconceptions

As CENOS survey shows, price, time to learn, lack of educated simulation engineers, software complexity and other reasons mentioned above are important decision points, but these are based on outdated misconceptions. On the contrary – today’s software is being built to remove these barriers and enable on-site simulation capabilities for SMEs. Let’s look at these statements a bit deeper.

Misconception: “Engineering software is too expensive for SMEs”

Large vendor solutions like ANSYS, Altair, DassaultSystѐmes, Hexagon cost many tens of thousands of dollars per year, which is a very high expense for a regular SME, but open-source based software or intelligent fit-for-purpose apps can make simulation much more affordable.

To offer a more affordable price CENOS Platform solution is being built with open-source algorithms and tools (GetDP, SALOME, ParaView) that are made by open-source communities and experts of the academic world.

In the long run, simulation software helps to reduce the number of design iterations down to one and save up to 80% of design time and costs. So investing in simulation software, in any case, will give an overhead to manufacturing SMEs.

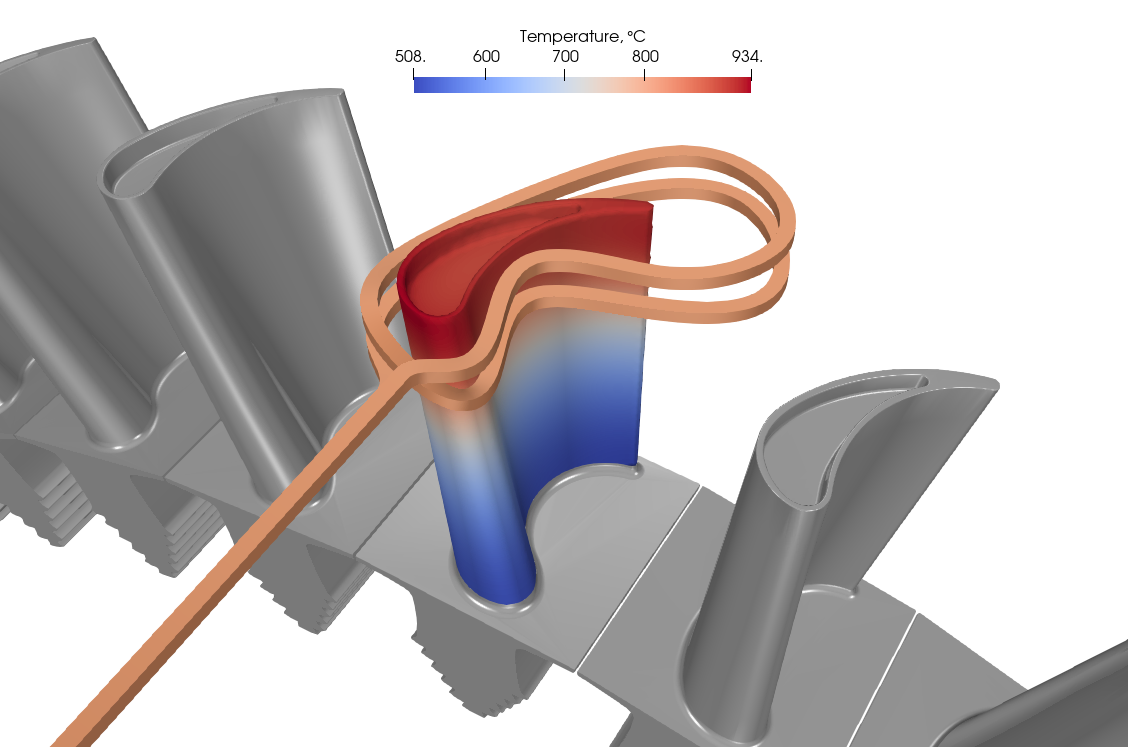

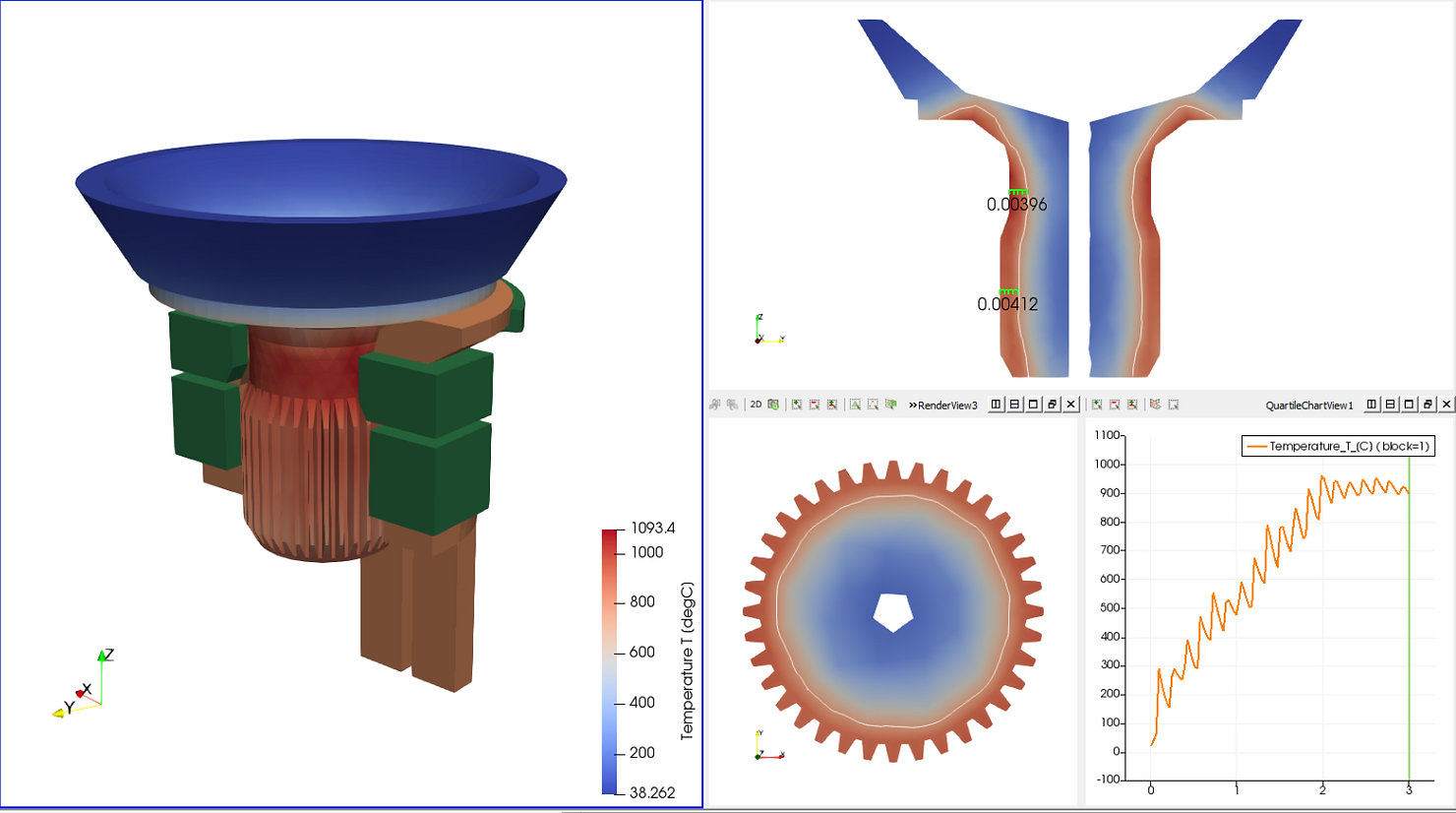

Picture: CENOS Platform simulating turbine blade

Misconception: “Simulation software training takes months”

Training to work with large vendor multi-purpose software may take 3+ months, but this is not true with software and apps focused on specific tasks. But if you’re an SME engineer who works for example just with induction heating or antenna design, then software like CENOS Platform would be enough for them because it has a thought-through user experience design focused just on induction simulation, made easier with the help of templates and automated meshing.

Misconception: “Simulation systems are hard to learn”

Engineering simulation software is still typically used only by simulation engineers and it’s important to expand the usage to a broader audience, beyond expert analysts. SMEs need a solution that has a little overhead infrastructure, is simple to use and can be adapted to changing

customer usage and requirements. That’s where “appification” comes in and makes work easier with industry focussed apps. The engineer using a focused simulation app doesn’t have to have a simulation engineer degree. There are a lot of tutorials that help engineers with a base knowledge to understand simulations. Some software offer templates, that give the engineer a base to start from and make his/her first simulation model within a day.

Picture: CENOS Platform simulating single-shot hardening

Misconception: “Simulations are not needed for my business due to the product simplicity”

Some engineers and managers in the manufacturing industry think that implementing Industry 4.0 technologies are not applicable to their business, but this is a very wrong mindset because digital modeling and simulations can help:

- reduce the number of physical prototypes, processes;

- increase capability to innovate (e.g. design lighter and stronger metal parts for engines);

- reduce the energy and time used in the production process;

- reduce product failure risks and various costs;

- reveal problems, weaknesses;

- redesign products to be lighter, use less material;

- expand operations without being limited to the know-how of one key employee (this is crucial but frequently forgotten) and more.

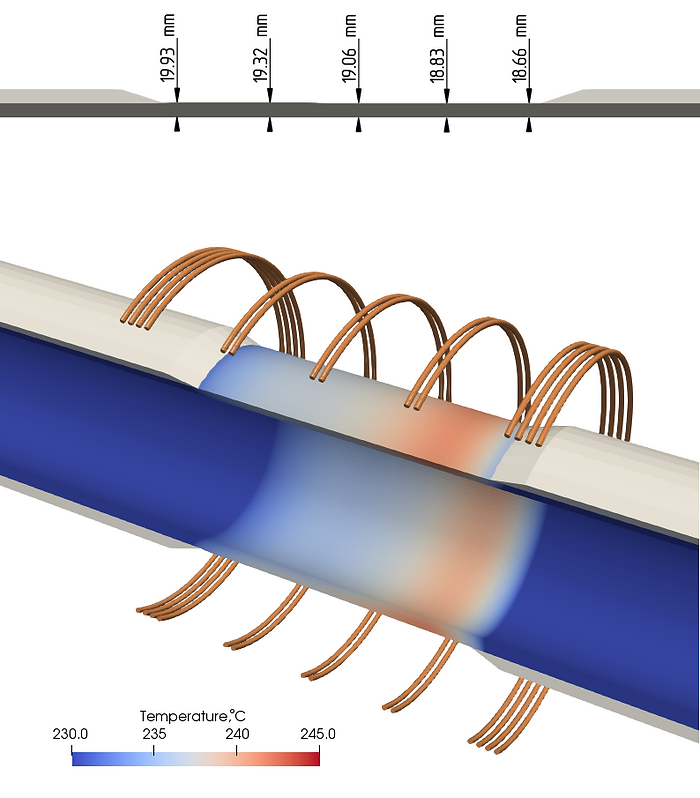

Picture: CENOS Platform visualisation of field joint coating

Future forecast

As KBV Research states: “demand for simulation software grew due to increased R&D (research & development) investment in different industries, including the aerospace and defense industries, automotive, and healthcare. Furthermore, the growth of this market is driven by the rise in demand for reduced product development times and reduced costs. Due to new trends including digital twin support, additive manufacturing, real-time simulation, and successful use of IoT and data analytics for simulation, the simulation software market is expected to grow exponentially.”

In fact, IDC forecasts that 40% of IoT platform vendors and 70% of manufacturers will be making use of digital twin technology by 2022. A digital twin is a virtual replica of a physical product or service. When a digital twin is made, it allows engineers to analyze more data faster, test and build equipment in a virtual environment, make stronger and longer-lasting materials, prevent downtime, innovate new designs and products, and even plan for the future by using simulations.

Finally, as many respectable research institutions show – automotive, aviation, oil, medical, additive manufacturing, and many other industry leaders are all moving towards using predictive technologies, which involve big data, simulations, AI, etc. So implementing simulation systems in metal component manufacturing is not a question of “whether?”, but “when?” and “which one?”. Enterprise-grade software is costly and complex for SMEs and there is rarely a need to get it, but the market has simpler solutions to offer and that’s what SMEs should look for.

More on simulation software adaptation and democratization can be found on Rev-Sim.org.

Feel free to ask our support engineers (info@cenos-platform.com) more about the cases presented and induction heating simulation capabilities with CENOS Platform. Academic users (teachers, researchers, students) can download a free license and commercial users can get a 10-day free trial here: www.cenos-platform.com.